June 9, 2011

Dear Council Members and Citizens of Clarksville:

The budget process provides an annual opportunity to examine the City’s performance and our community’s economic health. Through the budget process, we have the ability to review what we did right and wrong in the current budget, assess our strengths and weaknesses, and plan for future opportunities and challenges that face the community of Clarksville. As your new Mayor, I have stated that my Administration will be transparent and open about our priorities and goals and that I will keep both the City Council and our citizens apprised of the City’s ongoing projects and our financial condition. Despite serving 12 years on the Tennessee House Finance, Ways and Means Committee and having a good understanding of governmental accounting, I think you can appreciate that with an overall City budget in excess of $418 million in one of the fastest growing Cities in Tennessee, that it has taken a few months for me to review all the areas included in the City’s budget. Therefore this budget will serve not only as the annual budget, but as my first update on the status of City projects and City finances.

As this budget was developed, one key concept had to be determined, “are we a community that lives in the past or a community planning for the future?” Taking my lead from the budget requests submitted by City Department Heads, this budget is a plan that both expects growth and manages that growth with a goal of providing excellent City services at a level that while affordable, still moves Clarksville toward being a top tier City. That is a City that you want to live in and if you don’t live here, then a City that you want to visit. We have assets that any City would covet, the fastest growing university in Tennessee, one of the largest industrial developments in the state, and it’s a green industry at that, access to rivers and natural beauty second to none and a growing quality of life that makes us a highly desirable community. Starting with this budget, I want to synergize these assets and work to make Clarksville the best place to live in Tennessee and the best community it can be.

While we can be proud of our history and our past achievements, we need also to plan for a future that will attract new businesses, new jobs and new opportunities so that our children and grandchildren can not only grow up here, but expect to live here, work here, carry forward the traditions of our community and enjoy the same quality of life we have all been afforded. This budget recognizes our sluggish national and state economies, but builds on the fact that Clarksville has consistently outperformed both. Our focus in this budget is on delivering the highest quality of service, maintaining existing infrastructure, enhancing our quality of life and planning for our possibilities, all in a fiscally responsible document.

Budget Overview

A total City budget will be provided once the Department of Electricity forwards their budget; last year’s total City Budget was $418,981,644 (including CDE’s budget). The proposed 2012 general fund budget is $77,967,469, which represents an increase of 8.1%, compared to the original $72.1 million budget for 2010-11. This increase is a combination of new employees to support our new Liberty Park and expanded Greenways, new employees to support a new revenue source (electrical permitting and inspections), much overdue raises to City employees, and some necessary capital projects. We have done this while managing to avoid a property tax increase and also planning for excess fund balance over our required 20% because I feel that it is imperative that we have the budgetary flexibility to deal with the unexpected.

Highlights of the Proposed 2011-12 Budget

- The budget is balanced with revenues that exceed expenses (appropriations).

- The budget is in compliance with the adopted fund reserve policy.

- Essential service levels are maintained or enhanced.

- There are 15 full time and 19 part time new staff (see chart for departmental detail).

- A general salary increase based on the 2011 Pay Study results was enacted in 2011 for approximately 63% of our employees whose pay was not in line with the market and a 2% stipend for the remaining employees. Therefore no salary increases were included in the 2011-12 budget.

- The City’s property tax rate is projected to remain at $1.24 per $100 assessed valuation. This will be the 3rd year at this property tax rate.

- The proposed budget includes the cost associated with the opening of the newly renovated and expanded Liberty Park, year round operation of the Providence pool with its enclosed dome and the expansion of the Building & Codes Department services to include electrical permitting.

- The proposed budget includes one-time revenues of approximately $700,000 representing a transfer of excess reserves from our Self-Insurance Funds, $2.0 million being transferred from the Capital Project Revenue Fund, and $2.7 million in proceeds from a 5-year capital outlay note.

- While the proposed budget allows us to maintain proper service levels for a City that is growing and vibrant, it may not allow us to maintain our assets at an optimal level, which will be addressed in a later five year proposed budget plan.

General Fund Overview

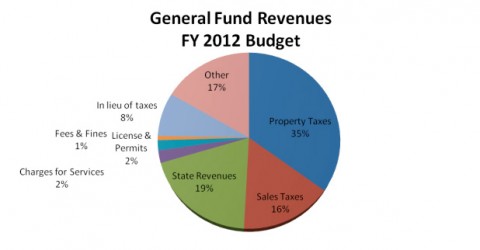

Revenues. Total general fund revenues for 2011-12 are estimated at $78.3 million, an increase of 16.9% over the 2010-11 original estimate of $67.0 million. Following is a summary of significant revenue sources and /or significant revenue changes.

- Property Tax. The single largest revenue source for the City is our property tax. Property tax collections, estimated at $27.8 million account for 35.5% of total general fund revenue. Property tax is split between the General Fund at $26.3 million and the Capital Project Revenue District at $1.5 million. CPRD is discussed in more detail below.

- Intergovernmental revenue. This is the City’s second largest category of revenue and is estimated at $15.8 million for 2012, an increase of 18.8% over the 2010-11 budget. This increase is due to the recently released census numbers and the city has budgeted additional revenue of $3 million based on our new population of 132,929. Much of the state’s shared revenue in this category is based on per capita formulas.

- Sales Tax. The City’s third largest revenue source is sales tax, which at $12.4 million accounts for 15.9% of general fund revenues. This represents a 4% increase over estimate actual sales tax collections for 2011 of $11.9 million. Clarksville’s economy continues to perform better than the state average in areas like sales tax revenues.

- License and Permits. The City’s revenue for license and permit fees is expected to increase by 34% with the addition of issuing electrical permits and performing electrical inspections through the Building & Codes Department. Although the department will be adding two employees to perform inspections, the City believes the additional revenues from this service, previously provided by the state, will enhance our revenues and result in faster service to our citizens. Building permit revenue for FY 2012 is projected at $1.4 million, an increase from the 2010-11 budget of 40.0% with the addition of Electrical Permitting. “Actual Estimated” revenues for 2011 are estimated to be down by 8% over FY 2010, reflecting a slowdown in construction during the current fiscal year.

- Other one-time revenues. Other revenues classified as one-time revenues include a rebate from the Internal Service Funds of $691,000, a transfer from CPRD to return property taxes to the General Fund of $2 million and projected proceeds from a five year capital outlay note of $2.7 million. We are also applying for FEMA grants to buyout some flood-prone properties and anticipate approximately $692,990.

?

Long Term Revenue diversification. As you know, the City has limited revenue opportunities and raising property tax, our largest single revenue source, is not a popular topic of mine or with our citizens. However, as our community continues to grow, we are challenged to not only manage our expenditures in a conservative manner, but we also are required to evaluate revenue options such as how we compare to other communities in areas like property tax rates.

| Tennessee Top 10 Cities | ||||

| Assessed Value and Tax Rates | ||||

| (arranged in order of tax rate) | ||||

| Tax Rate | Assessed Value | Population | Sales Tax** | |

| Memphis | $3.1957 | $ 12,053,353,530 | 676,640 | 9.25% |

| Knoxville | $2.8100 | $ 4,189,422,000 | 185,100 | 9.25% |

| Nashville* | $2.2000 | $ 16,413,282,722 | 605,000 | 9.25% |

| Jackson | $2.1000 | $ 1,254,178,318 | 63,732 | 9.75% |

| Chattanooga | $1.9390 | $ 4,845,694,497 | 171,350 | 9.25% |

| Johnson City | $1.9300 | $ 1,807,125,732 | 63,141 | 9.50% |

| Murfreesboro | $1.4900 | $ 1,160,302,747 | 105,209 | 9.75% |

| Bartlett | $1.4070 | $ 2,425,708,714 | 48,070 | 9.25% |

|

Clarksville

|

$1.2400

|

$ 2,184,595,767

|

132,929

|

9.50%

|

| Franklin | $0.4300 | $ 2,689,334,028 | 60,629 | 9.25% |

| Top 10 City Average | $1.8742 | $ 4,902,299,806 | 211,180 | |

*The Metro Davidson-Nashville tax rate is $4.04. Based on the Top 10 average(less Metro) being $1.838, we believe Nashville’s “City” portion to be a rate of $2.20.

**The Tennessee sales tax rate of 7% is included in the sales tax rate of each city.

| General Fund Revenues by Category | ||

| Comparison of Fiscal Year 2011 and 2012 | ||

| Estimated | Proposed Budget | |

| FY 10-11 | FY 11-12 | |

| Property Taxes | $ 25,419,996 | $ 27,440,759 |

| Sales Taxes | $ 11,901,831 | $ 12,406,506 |

| State Revenues | $ 12,343,791 | $ 15,327,433 |

| Charges for Services | $ 1,569,717 | $ 1,794,025 |

| License & Permits | $ 1,052,959 | $ 1,455,508 |

| Fees & Fines | $ 626,910 | $ 611,350 |

| In lieu of taxes | $ 6,076,575 | $ 6,300,000 |

| Other | $ 10,132,357 | $ 12,933,330 |

| Total | $ 69,124,136 | $ 78,268,911 |

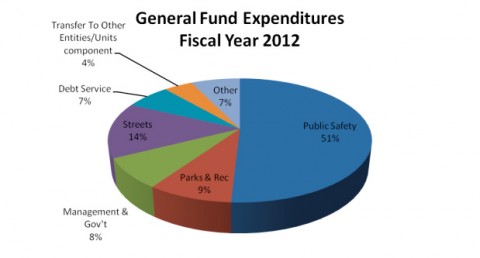

1Expenditures. Total general fund expenditure for the proposed budget is $78.0 million, an increase of 8.2% from the fiscal year 2010-11 budget. A summary of expenditure activities within the proposed budget by service area is charted below, showing that public safety functions account for 51% of the total proposed general fund budget.

|

General Fund Expenditures by Function

|

||

|

Comparison of Fiscal Year 2011 and 2012

|

||

| Estimated | Proposed Budget | |

| FY 10-11 | FY 11-12 | |

| Public Safety | $ 37,258,208 | $ 40,083,154 |

| Parks & Rec | $ 5,915,576 | $ 6,954,499 |

| Management & Gov’t | $ 7,077,035 | $ 7,364,007 |

| Streets | $ 10,307,549 | $ 11,554,869 |

| Debt Service | $ 5,184,338 | $ 4,072,959 |

| Transfer To Other Entities/Units component | $ 4,294,653 | $ 3,780,547 |

| Other | $ 3,008,819 | $ 4,157,434 |

|

Total

|

$ 73,046,178

|

$ 77,967,469

|

|

|

|

|

Salaries, Pay Study and related Cost. Salaries and benefits account for 63.8% of the total General Fund Budget. Of this percentage, approximately $3 million can be attributed to the raise from the Pay Study completed and enacted in 2011. Although the Pay Study only addressed the 63% of City Employees who were not comparable to the market, we recognize the need to treat all employees fairly compared to other Cities our size. Because of the generosity of Council in enacting the entire pay study in 2011 and because the pay study was enacted so late in the fiscal year, to balance the cost to our taxpayers, no pay increases are being recommended this year. We will need to continue to address our salaries as compared to the market in future years. Our citizens deserve quality services and to provide quality services we need to hire and fairly compensate a qualified and motivated City staff. When considering the 2011 pay increase where 37% or more of the employees received a 2% stipend, it is only fair to remember that in the four preceding years, 2007-2010, that the average wage increase for all employees was 1% or less. This during a time when the City workload was substantially increasing as evidenced by our increased population and increased operating expenses of 11.5% during those same four years.

New Employees. The following chart shows a breakdown of the proposed 15 new employees by department. Buildings and Codes is adding two electrical inspectors which are estimated to increase city revenues by about $400,000 annually. Garage is adding a mechanic to partially offset a position currently vacant due to an employee who is a reservist being deployed overseas and partially to offset the continued increase in the number of vehicles and equipment that are serviced. As we become more and more dependent on technology to do our daily jobs, I.T. is requesting a network administrator as a backup as well as spreading the workload in the department. The proposed new Internal Auditor will be partially funded by the Gas & Water Department and at some point should be fully funded once the CDE issues are resolved. The two Parks positions will be partially funded and only hired as some of our new projects come online. The two Police Department Domestic Violence Coordinators are positions that have been funded through a grant through September 2011, and although the grant has expired, this service is desperately needed by many of our citizens. Effective in January, we are proposing adding six new dispatchers and consolidating all dispatch functions into one location. Currently fire dispatches are handled by firemen and calls are transferred, but under the new arrangement all calls will be handled by dispatch, freeing up three firemen to help alleviate shortages at various stations.

| New Employee Requests | |||

| Fiscal Year 2012 | |||

| Total Cost | |||

| Department | Position* | Quantity | including benefits |

| Building Codes | Electrical Inspector | 2 | $ 87,285 |

| Garage | Mechanic | 1 | $ 42,411 |

| I.T. | Administrator | 1 | $ 47,361 |

| Internal Audit | Auditor | 1 | $ 65,666 |

| Parks | Athletic Coordinator | 1 | $ 26,519 |

| Facility Promotion Supervisor | 1 | $ 19,941 | |

| Police | Domestic Violence Coordinator | 2 | $ 65,852 |

| Dispatch | Dispatcher | 6 | $ 143,171 |

|

Total New Employee Requests

|

15

|

$ 498,206

|

|

| *These positions are only partially funded and do not start July 1. | |||

?

Liberty Park and the Marina. Due to delays and problems caused by extreme weather, the Liberty Park and Marina project seems to have had its fair share of local media coverage recently. It’s important to understand that the project is not just a marina, but rather is the Liberty Park renovation and Marina project. The Liberty Park renovations are designed to give better access to more people for even more events than the old Fairgrounds Park. Along with the addition of a marina and additional access to the Cumberland River, this project will be a destination for both our citizens and tourists to enjoy, while showcasing one of Clarksville’s best natural assets-the Cumberland River.

The Liberty Park renovation and Marina project is broken down into four equally important phases. Phase I often referred to as the “dirt excavation” phase, wasn’t focused only on the marina, but also included the forming of the larger fairgrounds and the groundwork for the new sports fields and ten-acre fishing pond. At an estimated cost of $8.2 million, it is the largest phase. Phase II, costing an estimated $6.87 million focuses on the utilities and landscaping for all the amenities at the park and marina and includes electric, gas, water, etc. Phase III is estimated at $6 million and includes the dog-park and pavilion, the Freedom Point pavilion and other pavilions and areas where families can picnic or just enjoy the beauty of the Cumberland River. Phase IV is estimated to cost $5.7 million and includes building the focal point of the project-the Wilma Rudolph pavilion. Despite major setbacks, including historic flooding and one of the wettest construction periods in recent history, the Liberty Park renovation and Marina project is currently in line with its budget. We are committed to this project and hopeful that upon completion that we will have an asset in our community that can be enjoyed for generations to come.

Public Safety. Public Safety, with approximately 71% of total general fund employees, accounts for approximately 40% of the increase in the general fund budget for 2012. This is a direct result of the pay study and should help the Police Department in particular in both hiring and retaining qualified police officers. The next largest increase for the department is fuel to keep its fleet moving, an increase of $254,000.

Parks and Recreation. The Parks budget increased approximately $1.3 million with the majority of the increase attributable to payroll and the majority of the payroll increase due to the ten new employees hired in the last quarter of 2011 for maintenance at the renovated Liberty Park. Because those employees were only budgeted for a small portion of the 2011 fiscal year, the increase is showing for 2012, along with two new positions.

Streets. During departmental budget presentations I was made aware of our deteriorating street conditions. Our overall paving condition index (PCI) for streets has fallen from 68 in 2003 to 55 in 2010, with 55 being the lowest PCI rating we can afford. We have 41% of our total streets already below that level and to refurbish streets below a PCI of 55 costs 4-5 times more than to maintain at a level at or above a PCI of 55. The estimated cost to bring our streets up to a middle ground of a PCI of 60 is approximately $5million. We will need to address this problem in immediate future budgets.

Debt Service Costs. We have a Debt Service Reserve policy that requires us to keep a reserve of 3% of variable rate loans outstanding and this will result in an increased transfer to Debt Service for 2011 of $264,445 over the original budget. However we plan to refund several of the larger variable rate loans in the 2012 fiscal year, in anticipation of rates increasing and this will allow us to reduce the Debt Service reserve by approximately $1 million in fiscal year 2012. The actual debt service payments due in 2012 are a prelude to higher debt service payments in future years as the extremely low variable rate loans now in place on several large projects begin to reflect higher interest rates as their rates adjust to market or if these loans are refunded into permanent fixed rate loans. Variable rate loans are approximately $60 million and include such projects as the tax-exempt portion of Liberty Park Renovation/Marina-$25,175,000, Dunlop Lane-$4,700,000, Peachers Mill Road-$11,750,000 and ADA compliance expenses dating back to 2005 of approximately $19,000,000. With variable rate loans in the .0025% range over the last several years, the City has saved several hundred thousand dollars in interest expense. As these rates adjust to 4% and 5% interest rates and bigger principal payments begin to come due, our debt service payments will increase substantially and this an area that needs attention in a five year budget plan in order to avoid surprises as the economy and interest rates change.

Capital Needs for this Budget. The City’s capital needs are normally in the $2 million – $3 million range and this year is no exception, with capital request of $2.7 million, including two fire trucks totaling $435,000. When possible the City has paid cash for these purchases, except for large dollar items like fire trucks. However, since the 2011 budget pulled our fund balance down to the minimum 20% of appropriations as required by city ordinances, these purchases need to be financed with a five year capital note. The cost of financing has been added to the budget. Capital items being requested include: 35 police vehicles replacing vehicles with over 130,000 miles, telephone and network rewiring at $210,000, fencing at Heritage Park at $160,000, a bucket truck at $142,000, a fire engine pumper at $275,000 and a fire engine tanker at $160,000. A complete list of proposed capital items is included as a budget schedule. Additionally, the City needs to fund long term debt amounts of $1,062,500 for the airport terminal and maintenance hangar, $750,000 for the City’s portion of the proposed Veterans

Hospital to be funded by the state except for matching shares by the city and county, and $600,000 for the final phase of the major overhaul of the museum HVAC system (the museum building is owned by the city and the museum is a component unit of the City).

Transit Cost and Update. Due to budget cuts and delays in receiving funding, the Transit Department is requesting additional funding of $313,067 over their 2011 request. Additionally, due to delays in funding, we need to consider helping Transit with their cash flows or be prepared to help with interest expense on a line of credit because of cash flow issues for their funding.

Community Development Cost and Update. For the first time in recent years, Community Development is asking for assistance with their budget because of federal dollars being reduced. Community Development funding is being cut by approximately 16.2% for next year. The City receives many benefits from Community Development, and by funding them in the amount of $75,000; other city departments will continue to benefit from CDBG activities. These benefits include funding for code enforcement, infrastructure improvements, streets and parks. The HOME grant requires a 25% match from non-federal funds and over the years, it has been difficult to meet this match requirement. By funding Community Development, the City will be helping with this match requirement and in a way helping itself.

Airport and Museum Funding. Funding of capital assets that should have a useful life of over twenty years needs to be handled as a long term debt. With a large amount of long term variable rate debt, we suggest borrowing for long term debt for the next two years and adding that to a refunding of one or more of the outstanding variable rate loans.

Outside Agency Funding. Due to limited resources and increased requests for funding each of the last few years, a Non-Profit Committee comprised of four City Council members was appointed to review the applications of local non-profit organizations and make budget funding recommendations to the City Council. Each agency received a score based on established criteria and any agency with a composite score of 50 or less was automatically eliminated from funding consideration. The funds available were then divided among the highest scoring agencies based on their composite scores and those funding recommendations are presented as a part of this budget recommendation. This process also resulted in reformatting our summary budget presentation to better recognize and segregate the funding for entities that are either a component unit of the City or an entity whose major assets are owned by the City or the City formed the entity and remains its major or only revenue source.

Utility Funds.

Clarksville Department of Electricity. Once we receive the budget numbers from the CDE, I will provide you with the CDE budget for your review and approval, as outlined in City Ordinance 27-2009-10 and the City Charter, Title 13, Chapter 1, Section 13-113 a. (1).

Clarksville Department of Gas, Water and Sewer. Operating revenues are projected to be $83.9 million; an increase of 6.7% over 2010, while expenditures are budgeted to increase by 5%. The department plans to eliminate outsourcing costs of $600,000 by hiring an additional 10 employees and performing the outsourced work in house. Total capital improvements are budgeted at $51.6 million and include reimbursements from the State of $48.4 million for expansion related to the Hemlock plant.

| New Employee Requests | ||

| Fiscal Year 2012 | ||

| Total Cost | ||

| Position | Quantity | including benefits |

| Utility Construction & Maint Assistant | 3 | $ 86,463 |

| Water Distribution / Wastewater Collection Specialist | 4 | $ 157,498 |

| Senior Utilities Equipment Operator | 1 | $ 41,972 |

| Water Distribution / Wastewater Collection Supervisor | 1 | $ 48,464 |

| Public Utilities Manager | 1 | $ 61,439 |

|

Total New Employee Requests

|

10

|

$ 395,836

|

Capital Project Revenue District. Since 2008, and including the $1.5 million from growth budgeted for transfer in 2012, we will have pulled some $6.2 million from general fund property taxes and transferred it to CPRD. Although the projects funded, through debt service and cash, are certainly worthy City projects, such as ADA compliance, Dunlop Lane, Peachers Mill Road, Liberty Park Renovation/Marina, the airport terminal and the Raymond Hand Bridge, the fact remains that we are taking the majority of our property tax increases from a selected area of our city and segregating them here. Normally those increases in property taxes would be available for all City needs, including pay increases and street paving. I believe that we need a dedicated revenue stream to use for special projects and in recruiting new business opportunities to Clarksville, but that revenue stream needs to be “new money” and not just moving dollars from one fund to another. We will receive the final payment associated with the district from the County this fiscal year and then I believe we need to take a serious look at the CPRD. That doesn’t mean that we will free up the approximately $2 million now slated for transfer to CPRD because the debt service on the projects financed will certainly take a large portion of the funds. I would suggest; however, that there is no particular reasoning for segregating these projects and that we add these back to our general fund expenditures giving a clear picture of our debts and how we fund them.

Capital Fund. In addition to financing approximately 90% of our normal capital expenditures through a five year capital note, there are additional projects that need to be funded through bonds. These include the remaining $1 million due on the construction of the airport terminal and our share of converting the old fire station to a maintenance hangar for the airport at $62,500, the City’s share of the proposed Veterans Hospital at $750,000 and the HVAC repairs to the museum at $600,000. I believe we can add this new money to a refunding of one of several outstanding variable rate loans and the estimated cost has been included in the budget. I am providing a complete list of the outstanding capital projects and their funding sources. Some of the outstanding projects include: Liberty Park renovation/Marina, STP grant funded street paving and the Spring Street remodel. I am suggesting that we remove the highlighted Spring Street remodel from our list and save this as a future project.

Special Revenue Funds. We have several special revenue funds. The Capital Project Revenue District is perhaps the most familiar one, and I have already discussed that. Of the others, the most significant would be the Community Development Funds. We have already approved their budget proposal for the coming year. The Police Special Revenue Fund is significant to us as the fund in which we account for several hundred thousand dollars worth of public safety related grants to include Domestic Violence Grants and JAG Grants. Through our joint efforts with the Federal Government, we also anticipate receiving more than $200,000 in seized funds. The Parks Special Revenue Fund collects funds for specific parks/recreation functions such as softball league fees and Rental of Facilities. We also record the revenue from the Redflex Cameras into a Police Special Revenue fund and a Parks – Trails Special Revenue Fund, as well as recording Special Events such as the July 3rd Celebration and Christmas on the Cumberland in a Special Events Revenue Fund. Each Special Revenue Fund is covered in an attachment detailing the amended FY2011 budget and the FY2012 budget request.

Cash Reserves and Bond Rating. A city’s financial health is often measured by its fund balance reserves and its bond rating. These key measurements affect everything from the city’s ability to continue as an entity to its ability to borrow funds for large projects and the interest rates paid when debt is incurred. Currently, the City is required to maintain a minimum fund balance of 20% of budgeted expenditures and transfers as adopted by Resolution 3-2009-10. The proposed budget for 2012 has a projected fund balance of $15,872,327 or 20.1% of budgeted expenditures and transfers. It is absolutely necessary that we adopt a budget with enough additional fund balance to be able to handle an emergency, whether that emergency be a natural disaster like the 2010 flood or an opportunity to bring a quality business to the community. Our current credit ratings ranging from AA to Aa2 put Clarksville in the top 16% of cities when it comes time to issue debt. This saves our taxpayers money and allows the City to do more with its funding resources. To maintain this rating we need to continue to adhere to our adopted fund balance policy and seriously consider raising our fund balance.

While our department heads recognize Clarksville’s growth and the ever increasing demand for services by an expanding population and while our department heads all have the desire to provide the very best service day in day out, they also recognize the costs associated with providing that level of service and the burden it puts on the average taxpayer. Therefore, the budget before you is a compromise that attempts to provide a high quality of service, while taking into account the limited resources and the tax burden that government puts on its citizens. During the next budget year, I propose taking a longer term look at our budget in order to let us plan for both our growth and the needs we have to maintain our current assets, in particular our streets and the associated paving program, and our need to provide additional services to our expanding population, to ensure that population has reasonable access to services, such as building and staffing a fire station and police station at Exit One and just as importantly, how we fund our needs, our growth and our future. I believe we are in the right location, that we have the right people and that we now need a clear vision and plan to make Clarksville the best community in Tennessee.