Tennessee Department of Commerce and Insurance (TDCI)

Nashville, TN – The Tennessee Department of Commerce and Insurance (TDCI) announces the approval of insurance rates requested by the five carriers offering coverage on the Federally Facilitated Marketplace (FFM) ahead of Open Enrollment for 2019.

Nashville, TN – The Tennessee Department of Commerce and Insurance (TDCI) announces the approval of insurance rates requested by the five carriers offering coverage on the Federally Facilitated Marketplace (FFM) ahead of Open Enrollment for 2019.

“This year’s approved rate filing requests are positive developments for Tennessee and our working families,” said TDCI Commissioner Julie Mix McPeak.

“Two carriers are entering Tennessee markets for the first time in 2019, and another is expanding its coverage area, resulting in more options for more Tennessee consumers. Tennesseans will see competition that currently does not exist in many parts of the state, including in and around Chattanooga, Knoxville, and Memphis. Additionally, for the first time in the ACA marketplace era, we have approved premium rate decreases from two longtime market participants,” McPeak stated.

The carriers and rates sought on the FFM for 2019 are as follows:

- BlueCross BlueShield of Tennessee. Statewide coverage except for Memphis and Nashville areas. Proposed 2019 rate request seeking an average decrease of 14.8%; premiums from $182.91 to $3,109.32.

- Bright Health. (New filing). Proposed coverage offered for Knoxville, Memphis and Nashville areas. Proposed premiums from $195.19 – $2,756.80

- Celtic Insurance. (New filing). Proposed coverage offered for Chattanooga and Memphis areas. Proposed premiums from $294 to $2,028.

- Cigna. Coverage continues in Nashville, Memphis, and Tri-Cities with proposed coverage expansion into Knoxville. Proposed 2019 rate request seeking a premium decrease of 12.9%; premiums from $243 to $2,966.

- Oscar Health. Coverage continues in Nashville with proposed coverage in Memphis. Proposed 2019 request seeking an average increase of 10.84% to 7.2%; premiums range from $196.19 – $2,345.20.

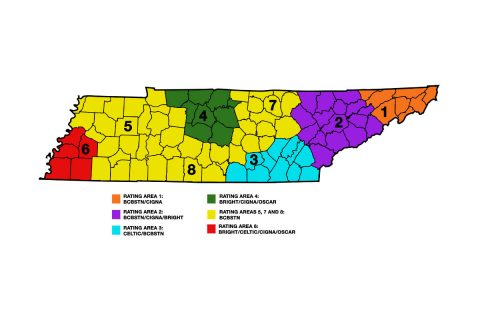

A map detailing the carriers’ plans across Tennessee’s eight rating areas can be found here.

Consumers should contact licensed insurance agents or company representatives in considering 2019 plan coverage.

The Centers for Medicare and Medicaid Services (CMS) must now review Tennessee’s approvals. Companies have until September 25th, 2018 to sign final agreements with CMS to participate in the marketplace next year.

Open Enrollment for 2019 begins November 1st, 2018 and lasts through December 15th, 2018.