Letter to the Leaf Chronicle sent Sunday July 9, 2006:

Letter to the Leaf Chronicle sent Sunday July 9, 2006:

In “Estate Tax Hurts Black Americans” (Leaf Chronicle July 9), Mr. Deroy Murdock quotes a study that showed that 90% of black business owners “believed” the estate tax hindered long term growth prospects. What people ‘believe’ is irrelevant in the tax code, however, it is a convenient way to spin the issue.

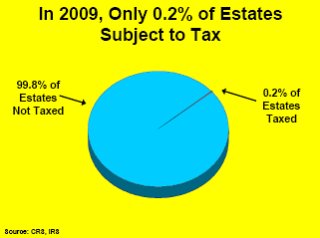

Mr. Murdock omits any facts about the tax, except for the rates – which is irrelevant to 98% of Americans. Per the IRS website (1), “In its current form, the estate tax only affects the wealthiest 2% of all Americans”, because it only effects estates with a net worth greater than $2 million dollars.

Let’s look at this in context, something Mr. Murdock does not do:

– In 1998, the average net worth of the top 1% of Americans was $10,204,000 and the average net worth of the bottom 40% was $19,400, a difference of 525% (2)

– 90% of US stocks are owned by the wealthiest 10% of Americans

Mr. Murdock sprinkles morsels of facts within his article that are severed from reality of the topic. And this web of spin was presented with no opposing view. You might say that this letter, if published, would be the lacking voice of opposition. But my letter to the local editor is limited in size, and if published would be days after Mr. Murdock’s national published opinion.

As a subscriber, I would like to see the opinion page address a topic with a healthy debate of issues that includes all the facts and ideas from all sides so that readers can be well informed and make well informed decisions.

(1) http://www.irs.gov/businesses/small/article/0,,108143,00.html

(2) www.pbs.org/peoplelikeus/resources/stats.html

A good friend of mine emailed me the following information taht I thought was interesting:

“If you factor in the Democrats proposal to raise the exemption to $5,000,000, then the estate tax would only affect the top 3,300 wealthiest people in the country! I got that from a very interesting book on the subject:

Perfectly Legal: The Covert Campaign to Rig Our Tax System to Benefit the Super Rich – and Cheat Everybody Else by: David Cay Johnston”

Thanks David!!

I think we need to have a total overhaul of the tax system with the emphasis being on simplicity, fairness, no exemptions, and definately no deductions.

Another friend of mine pointed me to a recent article by Molly Ivins on the subject. Here is the link in case anyone is interested.

http://www.creators.com/opinion_show.cfm?columnsName=miv