As of March 24 2008 the cheapest listed price of gasoline available in Clarksville was $3.08 per gallon for regular grade unleaded (courtesy of TennesseeGasPrices.com) with the indication that, for at least the moment, prices can be expected to remain stable. With the price of oil estimated at approximately $101 per barrel at the current moment, one gallon of gasoline costs approximately $2.61 to produce (figures courtesy of Bloomberg MarketData), meaning that there is a 15.26% profit margin being split amongst the relevant parties (and here we thought they were out to get us with unfair profit margins). Unfortunately for the rest of us, prices are likely to continue to increase for the foreseeable future for a variety of reasons which producers are largely powerless to stop.

As of March 24 2008 the cheapest listed price of gasoline available in Clarksville was $3.08 per gallon for regular grade unleaded (courtesy of TennesseeGasPrices.com) with the indication that, for at least the moment, prices can be expected to remain stable. With the price of oil estimated at approximately $101 per barrel at the current moment, one gallon of gasoline costs approximately $2.61 to produce (figures courtesy of Bloomberg MarketData), meaning that there is a 15.26% profit margin being split amongst the relevant parties (and here we thought they were out to get us with unfair profit margins). Unfortunately for the rest of us, prices are likely to continue to increase for the foreseeable future for a variety of reasons which producers are largely powerless to stop.

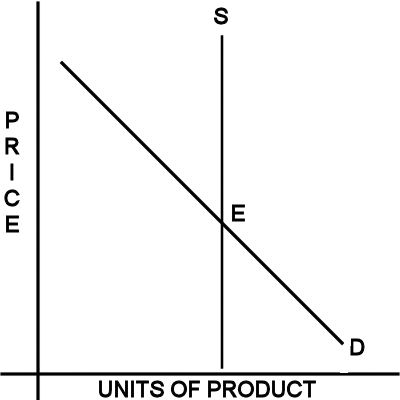

In the market, prices are ideally determined by the law of supply and demand. This can be represented graphically on a coordinate plane where units of product are on the x-axis and price is plotted along the y-axis. On this, a supply (S) and a demand (D) line are drawn. The supply line will start at the origin (0 units, 0 price) and increase going to the right (this makes logical sense: the more you can charge for something, the more you’re willing to sell). The demand line moves in the opposite direction starting high on the left and decreasing to the right (again this makes sense; the more of something there is the less we want to pay for it). Since the lines have opposite slopes in the same plane, they intersect. At the point where they intersect (E), the market is said to be in equilibrium, or, at the price indicated at the intersection, supply of something and demand for it are exactly equal to one another. Thus, one would hope, any reasonable person will realize that a change in either of these two lines will affect the prices you pay for a product.

Now, why the detour into the central dogma of economics? Because, that dogma dictates that prices for gasoline will continue to rise. The supply of gasoline is essentially fixed at the current point (or rather, the supply won’t be increasing. It could decrease, but let’s be real here). There’s one basic reason for this: oil companies are unable to produce oil at a rate higher than they have been. Exxon recently reported that its production will not be up this year from last year, despite the opening of several new fields for production. They cite two primary reasons for this:

- Hugo Chavez’s seizure of the entirety of their production capability in Venezuela (which, by the way, accounted for 15% of all consumption in the United States) and the significant losses incurred because of that action.

- The maturation of old oil fields. Oil fields eventually run dry and the company has to replace them. Exxon takes large capital outlays to replace its lost production and attempt to grow, but Exxon also states that locating new oil fields is becoming increasingly more difficult in the face of environmentalist driven legislation.

Given that Exxon is the largest such company in the world, one could reasonably expect other private companies to be in the same boat. So, let’s go back to that graph discussed earlier and make the supply line vertical (which, the astute person will realize implies that supply is constant, which isn’t strictly speaking true).

This now means that demand (which consumers’ control) is the price determining factor. Simply put, if more is demanded, the price is going to go up because consumers are bidding against other consumers for a limited resource. Of course, demand is increasing, astronomically as a matter of fact. China, and especially India, have rapidly expanding middle class populations who are entering the marketplace for gasoline (and other petroleum products). The respective governments around the world are buying stockpiles of petroleum in mass quantities, and, of course, the US military is buying it in droves (what do you think engines run on, half-baked invasion plans?). For the foreseeable future this doesn’t look to change. So, go back to the graph and take the demand line and shift it up and to the right. As you can see, the market equilibrium point is now at a higher price.

Now that you know the secret to rising gas prices, what can you do about it? The honest answer is virtually nothing. You’re stuck with petroleum until a viable replacement enters the market. In the United States a hard look is being taken at bio-fuels, which create their own problems. Hydrogen is being looked at as another alternative, although the capital outlay necessary for the infrastructure development needed is prohibitive in the current market (in other words, gas isn’t expensive enough that people are willing to pay for hydrogen yet). Your best bet is to buy a fuel efficient vehicle if you’re trying to save money on your gas bill. Toyota and Kia lead the market on this with Toyota offering vehicles in the $20k range with better than 40mpg and Kia offering vehicles in the $11k to $15k range with mid to upper 30s in mpg estimates. Happy hunting and safe driving.