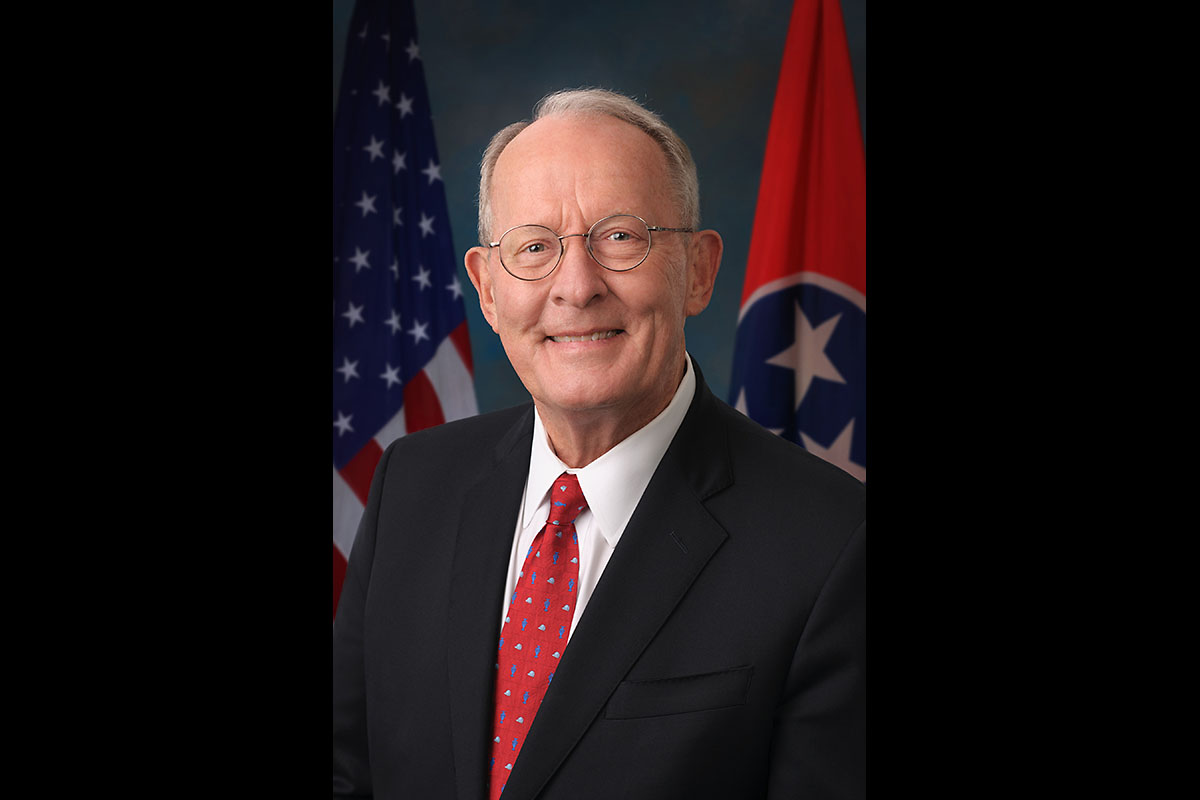

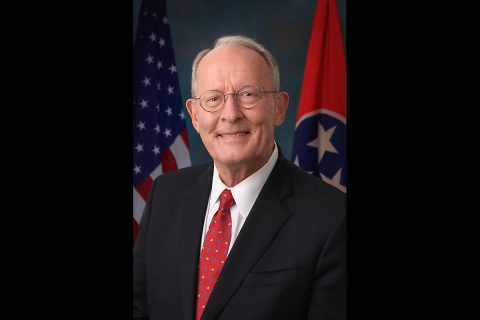

Washington, D.C. – Senate health committee Chairman Lamar Alexander (R-Tenn.) today said Congress is set to end the practice of surprise medical billing after it was announced that a bipartisan proposal to hold patients harmless from surprise bills and resolve payment disputes between providers and insurers will be included in broader government funding legislation that Congress will consider this week.

Washington, D.C. – Senate health committee Chairman Lamar Alexander (R-Tenn.) today said Congress is set to end the practice of surprise medical billing after it was announced that a bipartisan proposal to hold patients harmless from surprise bills and resolve payment disputes between providers and insurers will be included in broader government funding legislation that Congress will consider this week.

“It is time for Congress to make sure that patients don’t receive a surprise bill when they seek medical treatment,” Senator Alexander said. “Typically, one of five patients who go to an emergency room receives a surprise bill weeks later.”

“This practice has been especially damaging during COVID-19 when patients receive large unexpected bills weeks after they go to the emergency room. There will never be a broader bipartisan, bicameral solution to ending surprise medical billing and we should deal with it now. Patients cannot wait any longer,” stated Senator Alexander.

The proposal to end surprise medical billing will also allow approximately $18 billion in savings to be used to fully fund Community Health Centers, the National Health Service Corps, Teaching Health Centers Graduate Medical Education, and Special Diabetes Programs for three years.

The government funding legislation being considered by the Senate this week includes further provisions from the Lower Health Care Costs Act, which Alexander sponsored, including provisions to increase price transparency and lower prescription drug prices.

The bipartisan proposal was agreed to by House Energy and Commerce Committee Chairman Frank Pallone, Jr. (D-N.J.) and Ranking Member Greg Walden (R-Ore.), House Ways and Means Committee Chairman Richard E. Neal (D-Mass.) and Ranking Member Kevin Brady (R-Texas), House Education and Labor Committee Chairman Bobby Scott (D-Va.) and Ranking Member Virginia Foxx (R-N.C.), and Senate Health Committee Chairman Lamar Alexander (R-Tenn.) and Ranking Member Patty Murray (D-Wash.).

The bipartisan, bicameral agreement protects patients and establishes a fair payment dispute process including:

- Holds patients harmless from surprise medical bills, including from air ambulance providers, by ensuring they are only responsible for their in-network cost-sharing amounts, including deductibles, in both emergency situations and certain non-emergency situations where patients do not have the ability to choose an in-network provider.

- Prohibits certain out-of-network providers from balance billing patients unless the provider gives the patient notice of their network status and an estimate of charges 72 hours prior to receiving out-of-network services and the patient provides consent to receive out-of-network care.

- Creates a framework that takes patients out of the middle and allows health care providers and insurers to resolve payment disputes without involving the patient.

- Under the agreement, insurers will make a payment to the provider that is determined either through negotiation between the parties or an independent dispute resolution (IDR) process. There is no minimum payment threshold to enter IDR, and claims may be batched together to ease administrative burdens.

- If the parties choose to utilize the IDR process, both parties would each submit an offer to the independent arbiter. When choosing between the two offers the arbiter is required to consider the median in-network rate, information related to the training and experience of the provider, the market share of the parties, previous contracting history between the parties, complexity of the services provided, and any other information submitted by the parties.

- Following an IDR process, the party that initiated the dispute may not take the same party to arbitration for the same item or service for 90-days following a determination by the arbitrator. However, all claims that occur during the 90-day period are eligible for open negotiation and IDR after the 90-days.

- Provides additional consumer protections when insurance companies change networks, including a transition of care for people with complex care needs and appeal rights for consumers.

- Empowers consumers by providing a true and honest cost estimate that describes which providers will deliver their treatment, the cost of services, and provider network status.