Road projects are needed, and City taxes are not out of control

Clarksville, TN – Clarksville Mayor Joe Pitts has proposed a 20-cent property tax increase to fund Tier 1 of the Transportation 2020+ Strategy designed to overcome Clarksville’s pressing transportation improvement needs.

Clarksville, TN – Clarksville Mayor Joe Pitts has proposed a 20-cent property tax increase to fund Tier 1 of the Transportation 2020+ Strategy designed to overcome Clarksville’s pressing transportation improvement needs.

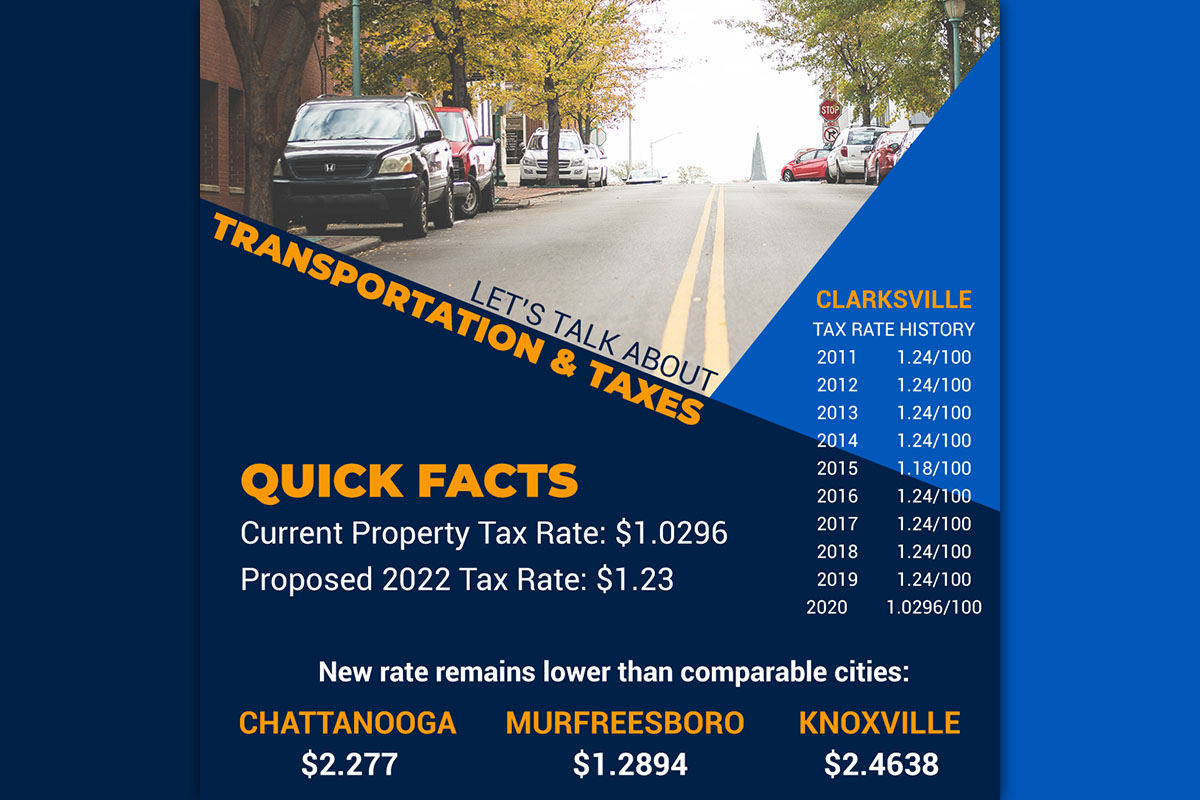

Here are some quick facts about the transportation strategy and the proposed tax increase:

- Transportation 2020 + Tier 1 proposes 13 priority projects needed to fight gridlock, improve mobility and ensure safe roadways. Tier 1 is estimated to cost $202 million to design, acquire right of way and construct. After grants, special revenues, and previously authorized allocations are subtracted from the total, the City would need to borrow $167 million to complete Tier1. View Tier 1 details here.

- Clarksville’s transportation problems stem from the ongoing rapid growth and success of our community, which is expected to continue. Clarksville has an ever-increasing number of people and vehicles using a road network that must be expanded.

- Clarksville’s major thoroughfares are state highways controlled by the Tennessee Department of Transportation. While the state has made improvements to this primary network and will continue to do so, this alone will not alleviate Clarksville’s traffic congestion, especially on City roads serving dense residential areas such as Whitfield Road, Tylertown/Oakland roads, Needmore Road, and the new Spring Creek Parkway. Significant investment is needed to build new and better City-owned roadways.

- The 20-cent tax increase would generate $6.9 million per year. This new revenue would be invested in roadway improvements. With the borrowing capacity of $167 million enabled by the tax increase, Tier 1 improvements would be completed in six years.

- The increase would take the property tax rate to $1.23 per $100.00 of assessed value. The average homeowner would pay about $84.00 a year, or $7.00 a month more in property taxes.

- Right now, Clarksville’s property tax rate is $1.0296 per $100.00 of assessed value, much lower than several comparable cities, such as Chattanooga at $2.277, Knoxville at $2.4638, and Murfreesboro at $1.2894. Clarksville’s tax rate, which has not been increased in more than a decade, has not been higher than $1.24 since 2011. This is not a record of out-of-control taxation by the City of Clarksville.

- Here are some important points of clarification about taxes and projects in Clarksville and Montgomery County:

- City and County governments have separate tax rates, budgets, and revenues. County government has different functions, different decision-makers, and different priorities — none of which are controlled by the City of Clarksville.

- Transportation 2020+ is a City of Clarksville initiative, based on the needs of the City’s transportation network and on the reality of the City of Clarkville’s budget and revenues.

- The Multi-Purpose Event Center being built downtown is a project of the Montgomery County government, not the City of Clarksville. Not building the MPEC would not provide a dime for the construction of City of Clarksville streets and roads. Conversely, building MPEC is not taking a dime away from building streets and roads in Clarksville.

- The wheel tax is set and collected by Montgomery County, which devotes those revenues to the County-funded school system. The City of Clarksville doesn’t receive any money from the wheel tax, so no wheel tax money can be used to improve City streets and roads.