Consider these ideas to help you make the most of your benefits

Clarksville, TN – Alongside other sources of income, Social Security can be a critical component of your total retirement resources, so it’s important to consider ways to optimize the value it can bring.

Clarksville, TN – Alongside other sources of income, Social Security can be a critical component of your total retirement resources, so it’s important to consider ways to optimize the value it can bring.

After all, these payments account for up to 40% of most retirees’ income, according to the Social Security Administration (SSA), with savings, pensions and retirement accounts making up the rest. Here are a few things you (and your spouse if you’re married) should think about as you get ready to retire.

When should I file?

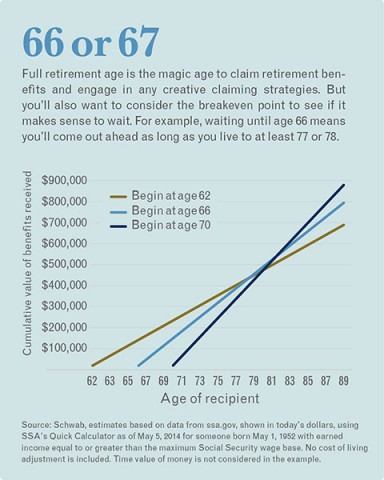

While several factors come into play, the simple answer is when you need the extra income. If that’s age 62, so be it. But if you have flexibility thanks to savings, consider delaying until at least your full retirement age (FRA) when you’re entitled to full benefits.

Filing earlier means you’ll receive permanently reduced benefits for the rest of your life, and it could limit survivors benefits paid to your spouse if you were the higher earner.

Waiting just three to four years past full retirement age (either 66 or 67, depending on when you were born) allows you to accrue delayed credits up to age 70, which will increase your benefits by 7% to 8% a year.

How should I claim my benefits?

The age you claim affects your options for receiving benefits. At full retirement age, you have more creative strategies at your disposal. And, couples have options as to how each will independently claim benefits in order to optimize the amount of money you both collect over your lifetimes.

You generally have one shot to claim a “mulligan.” Here’s what to do:

File an application to withdraw within 12 months.

Pay back all the benefits you’ve received (ouch!).

Delay benefits until a later age for higher checks. (If you claimed benefits on your own record before full retirement age, you can suspend payments.)

- Spousal benefits. If you are married and your spouse is the higher earner, you can collect up to 50% of what they are entitled to at full retirement age (if that person is at least 62 and has already filed for benefits). Collecting before FRA reduces your adjusted spousal benefits, while collecting after will not accrue delayed credits to your benefit. However, it’s important to note that your spouse’s claiming age does not impact your spousal benefit.

- File and suspend. Particularly helpful if only one spouse works, this strategy relies on the higher-earning person starting benefits at full retirement age, then his or her spouse (who must be at least 62) files for spousal benefits. The higher-earning spouse suspends benefits and opts to claim later in order to accrue delayed credits, while the other spouse continues with spousal benefits.

With all the complexities, it’s prudent to get professional help when calculating different scenarios and determining what filing strategy works best for you.

Can I switch between individual and spousal benefits?

Anytime you apply for benefits before FRA, Social Security assumes you’re filing for whatever benefits you’re eligible for and will pay whichever is higher – and only that. You’re locked in to a permanently reduced benefit.

What if I’m still working?

If you’re under full retirement age, receive a salary and have started claiming benefits, you’re subject to something called the earnings limits. That means if you make over $15,720 in 2015, Social Security will withhold $1.00 from your benefits for every $2.00 you make over the limit.

If you’re under full retirement age, receive a salary and have started claiming benefits, you’re subject to something called the earnings limits. That means if you make over $15,720 in 2015, Social Security will withhold $1.00 from your benefits for every $2.00 you make over the limit.

Don’t worry; your benefits will be recalibrated once you reach full retirement age and include the withholdings. If you continue to work past full retirement age, you’ll receive all of your benefits no matter how much you earn.

As you can see, benefits depend on your age, your marital status and employment. As your life changes, your Social Security strategy may need to as well. Your advisor can help with any necessary and allowable adjustments.