Clarksville, TN – The economic data were mixed. The ISM Manufacturing Index remained below the break even level in January, with a pickup in new orders and a softening in employment.

Clarksville, TN – The economic data were mixed. The ISM Manufacturing Index remained below the break even level in January, with a pickup in new orders and a softening in employment.

The ISM’s Non-Manufacturing Index slowed more than anticipated. The January Employment Report seemed to have something for everybody. Nonfarm payrolls rose less than forecast.

However, the unemployment rate edged lower, hours moved higher and average hourly earnings advanced – all likely to catch the attention of Fed policymakers.

The markets have written off further Fed rate hikes, but the reduction in slack suggests that officials should remain in tightening mode – looking to tighten further, but proceeding cautiously.

Next week, the People’s Bank of China reports its currency reserves on Sunday (the Shanghai market will be closed for the week due to the Lunar New Year). The PBOC still has plenty of reserves, but it is burning through them rapidly.

The focus in the U.S. is expected to be on Yellen’s monetary policy (before the House Committee on Financial Services on Wednesday and before the Senate Banking Committee on Thursday), but anyone expecting the Fed chair to wave a white flag and apologize for raising rates in December will likely go away disappointed.

Yellen should present an optimistic outlook for the economy, but will also concede that the balance of risks is weighted predominately to the downside. It’s an election year and the House committee is huge – so expect some yellin’ at Yellen.

Indices

| Last | Last Week | YTD return % | |

| DJIA | 16336.66 | 16069.64 | -5.79% |

| NASDAQ | 4504.24 | 4506.68 | -9.94% |

| S&P 500 | 1912.53 | 1893.36 | -6.29% |

| MSCI EAFE | 1584.256 | 1574.547 | -7.69% |

| Russell 2000 | 1010.298 | 1003.273 | -10.66% |

Consumer Money Rates

| Last | 1 year ago | |

| Prime Rate | 3.50 | 3.25 |

| Fed Funds | 0.38 | 0.06 |

| 30-year mortgage | 3.76 | 3.59 |

Currencies

| Last | 1 year ago | |

| Dollars per British Pound | 1.459 | 1.524 |

| Dollars per Euro | 1.121 | 1.148 |

| Japanese Yen per Dollar | 116.780 | 117.530 |

| Canadian Dollars per Dollar | 1.375 | 1.243 |

| Mexican Peso per Dollar | 18.281 | 14.788 |

Commodities

| Last | 1 year ago | |

| Crude Oil | 31.72 | 50.48 |

| Gold | 1157.60 | 1262.70 |

Bond Rates

| Last | 1 month ago | |

| 2-year treasury | 0.71 | 0.98 |

| 10-year treasury | 1.85 | 2.17 |

| 10-year municipal (TEY) | 2.60 | 2.83 |

Treasury Yield Curve – 02/05/2016

As of close of business 02/04/2016

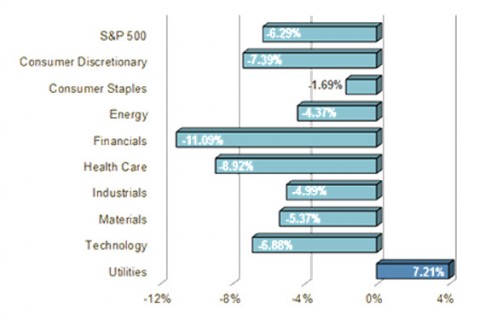

S&P Sector Performance (YTD) – 02/05/2016

As of close of business 02/04/2016

Economic Calendar

| Feb 7 | — | Chinese Currency Reserves (January) |

| Feb 10 | — | Yellen Monetary Policy Testimony (House) |

| Feb 11 | — | Jobless Claims (week ending February 6) Yellen Monetary Policy Testimony (Senate) |

| Feb 12 | — | Retail Sales (January) |

| Feb 15 | — | Presidents Day Holiday (markets closed) |

Important Disclosures

US government bonds and treasury bills are guaranteed by the US government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. US government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the US government.

Commodities trading is generally considered speculative because of the significant potential for investment loss. Markets for commodities are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. Specific sector investing can be subject to different and greater risks than more diversified investments.

Tax Equiv Muni yields (TEY) assume a 35% tax rate on triple-A rated, tax-exempt insured revenue bonds.

![]() Material prepared by Raymond James for use by its financial advisors.

Material prepared by Raymond James for use by its financial advisors.

The information contained herein has been obtained from sources considered reliable, but we do not guarantee that the foregoing material is accurate or complete. Data source: Bloomberg, as of close of business February 4th, 2016.