Market Commentary by Scott J. Brown, Ph.D., Chief Economist

The economic calendar was thin. Jobless claims remained low, consistent with a low level of job destruction. However, the March JOLTS data (that’s the Job Openings and Labor Turnover Survey) continued to show relatively low rates of hiring and quits. Fed Chairman Bernanke spoke in some detail about how the Fed is monitoring the financial system for vulnerabilities.

The economic calendar was thin. Jobless claims remained low, consistent with a low level of job destruction. However, the March JOLTS data (that’s the Job Openings and Labor Turnover Survey) continued to show relatively low rates of hiring and quits. Fed Chairman Bernanke spoke in some detail about how the Fed is monitoring the financial system for vulnerabilities.

One concern is that accommodative monetary policies could lead to excessive risk-taking. Bernanke said the Fed is watching for that, but he did not say whether it is currently seeing it. China indicated that it would move to free up capital flows into and out of the country. That’s one step toward eventually become an important global currency (although there is a long way to go) and will likely lead to a strengthening of the currency in the near term. Treasury reported a large budget surplus for April, implying a smaller-than-expected deficit for FY13.

The positive sentiment in equities continued, with the DJIA pushing above 15,000. Bond yields moved higher on concerns that the Fed is considering when to begin tapering its asset purchases. Commodity prices fell. The dollar strengthened.

Next week, a number of the mid-month economic reports will serve as important hurdles for the financial markets. The biggest will be the retail sales report, which kicks off the week. Unit auto sales fell (relatively to March) and gasoline prices declined, which should put downward pressure on the headline sales figure. Core retail sales are expected to have been lackluster. Industrial production should be restrained in April by a drop in the output of utilities (following a cold-weather boost in March) – manufacturing output is expected to be mixed across industries but generally soft. Seasonal adjustment will amplify the impact of lower gasoline prices in the inflation reports. Core inflation is expected to remain mild.

Indices

| Last | Last Week | YTD return % | |

| DJIA | 15082.62 | 14831.58 | 15.10% |

| NASDAQ | 3409.17 | 3340.62 | 12.90% |

| S&P 500 | 1626.67 | 1597.59 | 14.06% |

| MSCI EAFE | 1767.32 | 1737.37 | 10.18% |

| Russell 2000 | 966.26 | 939.85 | 13.76% |

Consumer Money Rates

| Last | 1-year ago | |

| Prime Rate | 3.25 | 3.25 |

| Fed Funds | 0.13 | 0.11 |

| 30-year mortgage | 3.35 | 3.83 |

Currencies

| Last | 1-year ago | |

| Dollars per British Pound | 1.550 | 1.613 |

| Dollars per Euro | 1.311 | 1.295 |

| Japanese Yen per Dollar | 99.350 | 79.670 |

| Canadian Dollars per Dollar | 1.002 | 1.002 |

| Mexican Peso per Dollar | 11.972 | 13.459 |

Commodities

| Last | 1-year ago | |

| Crude Oil | 96.39 | 96.81 |

| Gold | 1471.15 | 1590.34 |

Bond Rates

| Last | 1-month ago | |

| 2-year treasury | 0.23 | 0.23 |

| 10-year treasury | 1.90 | 1.73 |

| 10-year municipal (TEY) | 2.98 | 3.06 |

Treasury Yield Curve – 05/10/2013

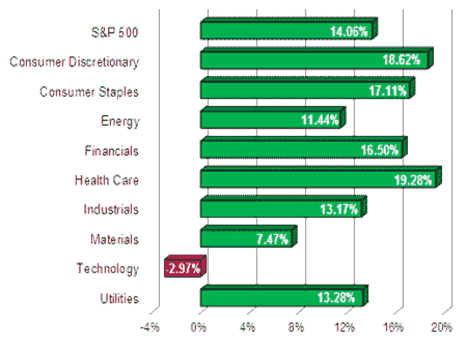

S&P Sector Performance (YTD) – 05/10/2013

Economic Calendar

| May 13th |

— |

Retail Sales (April) Business Inventories (March) |

| May 14th |

— |

Small Business Optimism Index (April) Import Prices (April) |

| May 15th |

— |

Producer Price Index (April) Empire State Manufacturing Index (May) Industrial Production (April) Homebuilder Sentiment (May) |

| May 16th |

— |

Jobless Claims (week ending May 11th) Consumer Price Index (April) Residential Construction (April) Philadelphia Fed Index (May) |

| May 17th |

— |

Consumer Sentiment (mid-May) Leading Economic Indicators (April) |

| May 22nd |

— |

Existing Home Sales (April) Bernanke JEC Testimony FOMC Minutes (May 1st) |

| May 23rd |

— |

New Home Sales (April) |

| May 24th |

— |

Durable Goods Orders (April) |

| May 27th |

— |

Memorial Day Holiday – markets closed |

| June 7th |

— |

Employment Report (May) |

| June 19th |

— |

FOMC Policy Decision, Bernanke Press Briefing |

Important Disclosures

US government bonds and treasury bills are guaranteed by the US government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. US government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury bills are certificates reflecting short-term (less than one year) obligations of the US government.

Commodities trading is generally considered speculative because of the significant potential for investment loss. Markets for commodities are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising. Specific sector investing can be subject to different and greater risks than more diversified investments.

Tax Equiv Muni yields (TEY) assume a 35% tax rate on triple-A rated, tax-exempt insured revenue bonds.

![]() Material prepared by Raymond James for use by its financial advisors.

Material prepared by Raymond James for use by its financial advisors.

The information contained herein has been obtained from sources considered reliable, but we do not guarantee that the foregoing material is accurate or complete. Data source: Bloomberg, as of close of business May 2nd, 2013.

©2013 Raymond James Financial Services, Inc. member FINRA / SIPC.